Building a house used to feel like a huge, expensive project only possible for people with a lot of money or access to big loans. But that’s changing.

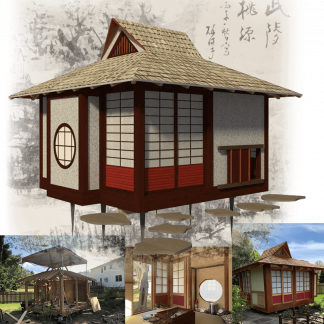

More people are turning to small houses—tiny homes, cabins, and backyard cottages—as a smarter and more affordable way to live. Whether you’re downsizing, looking for a guest house, or just want a peaceful place to escape on weekends, small homes offer freedom without the huge price tag.

Design websites have made it even easier. They offer detailed building plans for all kinds of small homes, from off-grid cabins to stylish micro cottages.

These plans are made for people who want something practical, good-looking, and doable on a budget. But even though small homes cost less, you still need to think about how you’ll pay for materials, tools, and any extra help.

If you don’t have all the money saved up, that’s okay. A personal loan can help you get started on your project sooner without waiting years to save every penny.

It’s a flexible option that gives you the money you need upfront, with the freedom to pay it back over time.

In this article, we’ll look at how to plan your budget, how to use a personal loan payment calculator to see what you can afford, and why investing in a small home is worth it.

Budgeting for Your Project

Before you apply for any loan, you need to know how much money you’ll need. This means sitting down and listing all the costs.

Think about materials, tools, land (if you don’t already own it), delivery charges, and labor if you’re hiring help. Don’t forget to include things like permits and utility connections. If you’re buying plans from a site like Pin-Up Houses, that cost should go into your total too.

Once you have an estimate, add a little extra as a buffer for surprises. It’s common for small things to come up once construction begins.

Maybe you’ll need more wood than you thought, or you’ll want to upgrade something along the way. Having a realistic budget from the start will make your loan application more accurate and give you peace of mind as you build.

Using a Personal Loan Payment Calculator

Once you know your budget, it’s time to figure out how to pay for it. A personal loan is a popular choice because it doesn’t require putting up your home or car as collateral. Most lenders offer fixed interest rates, so you’ll pay the same amount each month until the loan is paid off.

But how do you know if you can afford it? That’s where a personal loan payment calculator comes in handy. This online tool lets you plug in the loan amount, interest rate, and term length. It then shows you what your monthly payments would look like.

For example, if you borrow $10,000 with a 7% interest rate over 5 years, the calculator will show you the monthly payment and how much interest you’ll pay in total. It helps you see if the payments fit into your budget before you commit. You can try different amounts and loan terms to find the best option for your situation.

This kind of calculator is free and easy to use. It’s one of the best ways to plan ahead and avoid financial stress down the road.

Why Small Homes Are a Smart Investment

There’s a growing interest in small and tiny homes for good reason. They cost less to build and maintain. They use fewer resources and energy. And they offer flexibility—whether you’re placing one in your backyard, on rural land, or even planning to move it from place to place.

Sites like Pin-Up Houses provide building plans for small homes, cabins, sheds, and cottages. These plans are made for people who want to build something themselves or with a little help. The designs are practical and attractive. You can choose one that fits your style and your needs.

Many people use these small homes as rental units, guest houses, or art studios. Some even live in them full-time. If you’re paying rent or a large mortgage, a small home could be a more affordable and simpler way to live.

Planning Ahead Makes All the Difference

Building a house, even a small one, takes effort and planning. But it doesn’t have to be stressful. When you take the time to plan your budget, research your financing options, and use tools like loan calculators, you’re setting yourself up for success.

Getting a personal loan might be just what you need to bring your small house plans to life. It’s important to borrow only what you need and to make sure the monthly payments fit comfortably within your budget. With the right loan and a solid plan, you can build something that’s truly yours.

So whether you’re dreaming of a cozy cottage, a modern tiny home, or a simple cabin in the woods, take the first step by exploring your options. A well-planned project with the right financing can help make your dream of homeownership a reality—even on a smaller scale.

Conclusion

Building a small home can be both exciting and practical. Whether you’re dreaming of a quiet cabin retreat or a compact, stylish home of your own, careful planning and smart financing are key.

A personal loan gives you the flexibility to start your project sooner, without waiting years to save up. And by using a personal loan payment calculator, you can make sure your monthly payments stay within a comfortable range.

Small homes are more than just a trend—they’re a way to live with less stress, lower costs, and more freedom.

With the right plan, the right tools, and a clear budget, your small house project can become a reality. It’s not just about building a home. It’s about building a space that fits your life.